On the 25 January 2021, the ILF hosted the online conference “Green Banking and Green Central Banking: What are the right concepts?” with more than 1000 participants signing up for the event.

View <link seminars conference-materials _blank external-link-new-window internal link in current>Videos of the Conference.

The conference commenced with introductory and welcome words by Andreas Cahn (Director of the Institute for Law and Finance) and Patrick Kenadjian (Senior Counsel at Davis Polk & Wardwell London LLP), whereby both strongly emphasized the increasing importance of having a sufficient capital supply for projects which help to mitigate the climate catastrophe.

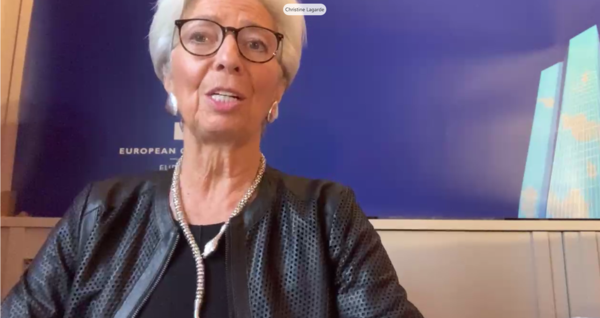

In her keynote address, Christine Lagarde (President of the European Central Bank) spoke about the general role of central banks in tackling climate change. On the one hand, she stated that in general, the ECB and central banks are not the main driving force in the mitigating process. On the other hand, she was of the view that central banks cannot just lean back and do nothing. She stressed three main points (the three “I”s), where the ECB and central banks can assist in the transition to a green economy. She first listed “Including” which means that the costs of CO2 as an externality should be reinternalized. The second “I” stands for “Information” because the market’s pricing mechanism for CO2 only works when there is a common definition of what “green” is. The last “I” stands for “Innovation” and she highlighted the enormous capital need for green innovation. These innovations depend on liquid and deep markets for green financial products. In conclusion, she explained how central banks are currently tackling climate change such as the NGFS (Network for Greening the Financial Sector) and stress tests which take the climate change into account.

The 1st Panel Discussion: “The Role of the Financial Sector”

The 1st panel discussion was moderated by Ted Moynihan (Managing Partner and Head of Financial Services at Oliver Wyman). The panelists included Günther Bräunig (Chief Executive Officer at KfW Bankengruppe), Wiebe Draijer (Chairman Managing Board (CEO) at Rabobank), Daniel Mminele (CEO at Absa Group and former Deputy Governor of the Reserve Bank of South Africa), and Christian Sewing (CEO at Deutsche Bank).

Christian Sewing commenced by underlining the increasing importance of ESG in the financing process. Daniel Mminele agreed from the South African’s point of view but pointed out that ESG in the African continent does not receive the same prioritization as in Europe, but that there is still a huge demand for ESG products. Wiebe Draijer endorsed that view from the perspective of the food industry where sustainability is becoming more important. He pointed out three crucial aspects of the financing process of sustainable projects. “Return” - where he emphasized that almost all sustainable projects generate a return, but that investors need to have more moderate expectations regarding the return. “Risk” - where he highlighted the ability of banks to manage risks. “Duration” – where he underscored that sustainable projects are long-term projects. Günther Bräunig explained how public financing can support the risk-bearing side of sustainable projects. He stressed that an involvement of public funds in projects would offer incentives to private investors. All panelists agreed that the risks of climate change are being increasingly considered by investors. Günther Bräunig, when asked by Ted Moynihan, opined that CO2-pricing should be market-driven.

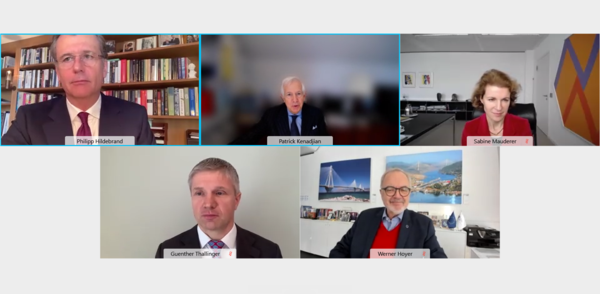

The 2nd Panel Discussion: „The Chance for Europe“

The 2nd panel discussion was moderated by Patrick Kenadjian. The panelists were Werner Hoyer (President of the European Investment Bank), Philipp Hildebrand (Vice Chairman of BlackRock and former President of the Swiss National Bank), Sabine Mauderer (Member of the Executive Board of the Deutsche Bundesbank), and Günther Thallinger (Member of the Board of Management at Allianz).

Werner Hoyer began by emphasizing that the European Investment Bank is the biggest financial supporter of sustainability. Sabine Mauderer explained in her opening statement that Europe does not have an alternative. She also insisted that climate risks are financial risks and therefore need to be mitigated. In order to mitigate those risks, information is needed and the disclosure rules need to be uniform for a functional pricing mechanism to be in place. Philipp Hildebrand agreed and added that Blackrock as an asset manager understands the consideration of climate risks as a fiduciary duty towards their investors. Private capital will be needed to tackle climate change. Therefore definitions of what is „green“ are needed. Günther Thallinger explained the viewpoint of Allianz and its position as a long-term investor. Financial goals and environmental goals are equally relevant in investment decisions. In the following discussion, the panelists turned towards topics such as risk-bearing, the modernization of the African continent where the power demand will rise rapidly, and the unification of standards in terms of sustainability. When asked by Patrick Kenadjian what the main goals for 2021 should be, Sabine Mauderer replied that she would like to see CO2 being priced. Günther Thallinger responded that he would wish for more long-term investors in 2021.

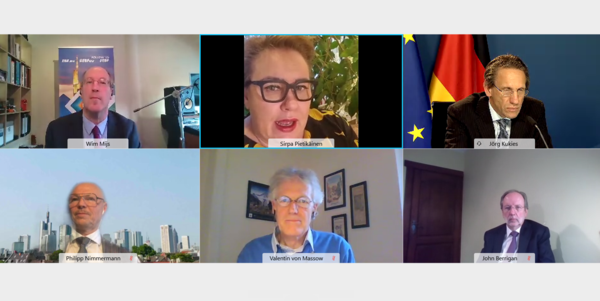

The 3rd Panel Discussion: “The Role of Government Authorities”

The 3rd panel discussion was moderated by Wim Mijs (Chief Executive Officer of the European Banking Federation). The panelists were John Berrigan (Director General of the European Commission), Sirpa Pietikäinen (Member of the European Parliament), Philipp Nimmermann (State Secretary for Economic Affairs at the Ministry for Economic Affairs, Energy, Transport and Housing of Hesse), Jörg Kukies (State Secretary at the German Federal Ministry of Finance), Valentin von Massow (Chairman of WWF Germany).

All the panelists unanimously agreed on the importance of having coherent and appropriate public actions in the form of investment and regulatory measures. Those measures comprised, inter alia, a clear taxonomy and increased transparency with regard to ESG factors. Several panelists also emphasized the importance of conveying to the public the complementarity of strengthening and greening the economy. Further assistance for the private sector through common platforms that support private actors in the implementation of sustainable projects as well as harnessing the risk management abilities in the financial sector in order to help clients understand and manage sustainability risks were also recommended. The panelists concluded that, with the right set of regulations and investment incentives, Europe would have the potential to become the leading market for sustainable finance.

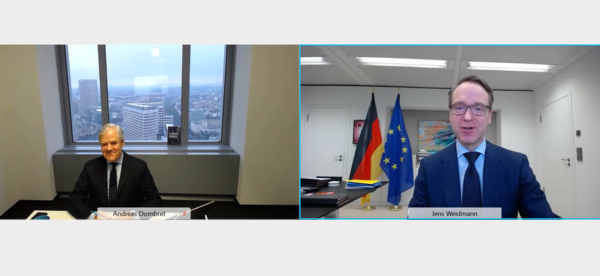

The 4th Panel Discussion: “The Role of Central Banks, Regulators and Supervisors”

Jens Weidmann (President of the Deutsche Bundesbank) opened the 4th panel discussion with his introductory remarks. He pointed out the potential conflict between the mandate of central banks and the public demands for them to assume a more active role in combating climate change. According to him, although climate change posed a risk for price stability and the stability of the financial system which are to be considered by central banks within their mandates, further public action against climate change is the task of democratically elected and accountable officials and not of independent central banks.

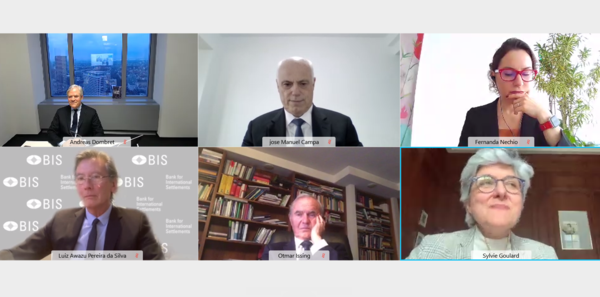

The 4th panel discussion was moderated by Andreas Dombret, (Global Senior Advisor at Oliver Wyman and former Member of the Executive Board of the Deutsche Bundesbank and of the Supervisory Board of the European Central Bank)

The panelists José-Manuel Campa (Chair of the European Banking Authority), Sylvie Goulard (Deputy Governor of the Banque de France), Otmar Issing (President of the Center for Financial Studies at Goethe University and former Chief Economist and Board Member of the European Central Bank and Deutsche Bundesbank), Fernanda Nechio (Deputy Governor of the Central Bank of Brazil), Luiz Awazu Pereira da Silva ( Deputy General Manager of the Bank for International Settlements and former Deputy Governor of the Banco Central do Brasil) and Andreas Dombret picked up the statements made by Jens Weidmann and discussed the implications of climate change for central banks’ mandates. In addition, the panel spoke about the difficulties of obtaining viable data and of modeling the economic consequences of climate change as a complex and non-linear phenomenon with potentially irreversible effects. The panelists underlined the value of existing and prospective cooperation among central banks regarding the exchange of climate change related data and best practices.

Concluding Remarks

Andreas Dombret gave the concluding remarks for the conference by stressing the importance of policy certainty as well as the continued need for substantial public and private investments in sustainable projects.

He subsequently closed the event by thanking all participants for an encouraging conference and proposing further discussions on the highly important and urgent topics of the conference.